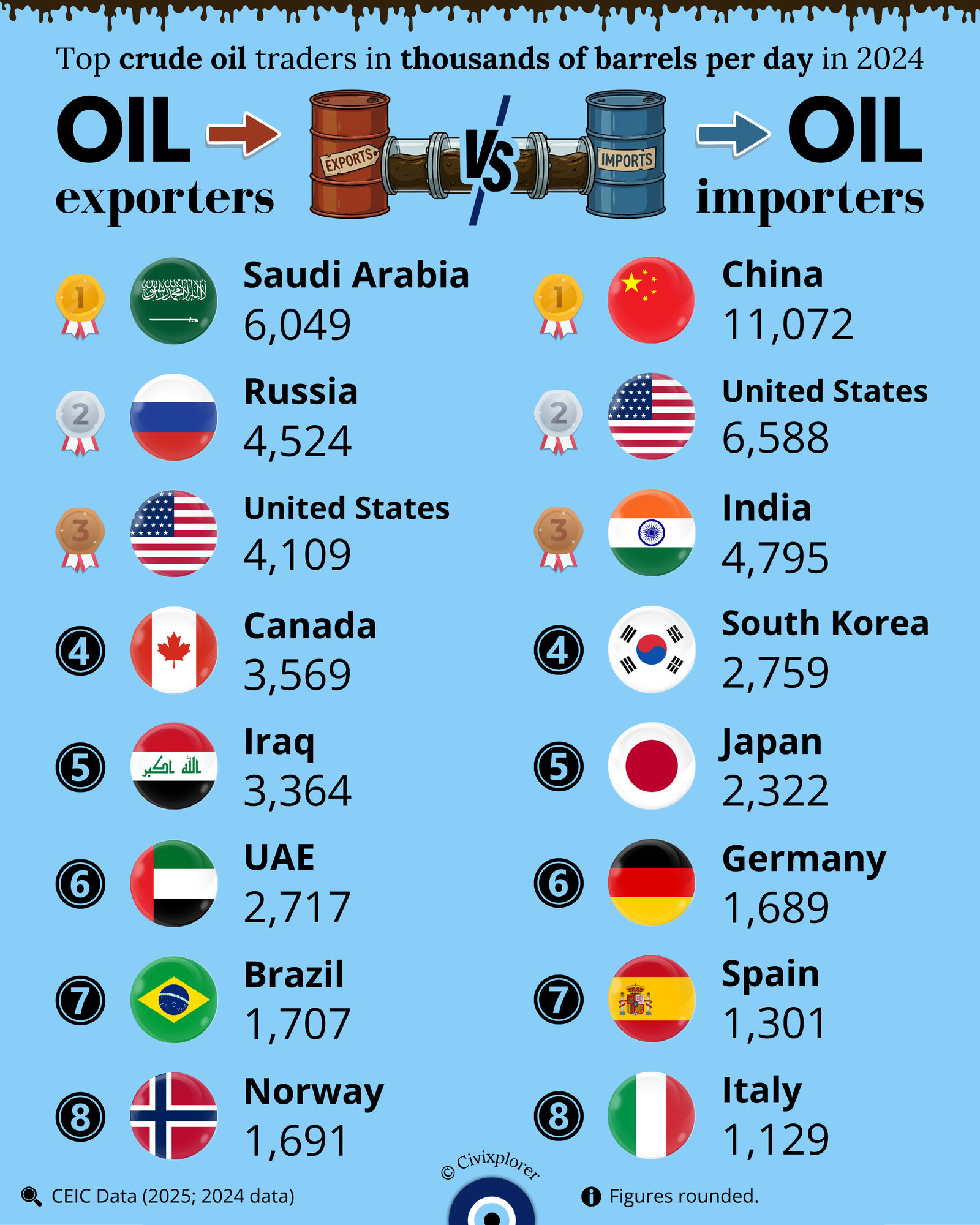

Crude oil flows define global power. Discover why the U.S. both imports and exports oil and how China handles its massive energy dependency.

The 🇺🇸 United States presents a unique energy paradox by ranking as both a top exporter and a top importer. While the country produces an abundance of light, sweet crude, many of its domestic refineries were originally built to process heavy, sour crude. Consequently, it is often more efficient to export the light oil they don't need while importing the specific heavy grades their infrastructure requires.

🇸🇦 Saudi Arabia continues to act as the global "central bank" of oil, leading the world with over 6 million barrels exported daily. Their remarkably low extraction costs, sometimes dipping below $10 per barrel, provide them with unmatched profit margins and significant influence over global pricing. 🇷🇺 Russia maintains its second-place ranking by successfully redirecting its exports toward 🇨🇳 China and 🇮🇳 India despite facing extensive international sanctions.

Import demand is heavily concentrated in East Asia, where 🇨🇳 China leads the world by importing over 11 million barrels per day. This reliance creates a strategic "oil chokehold," as the country must import more than 70% of its total supply to fuel its massive economy.

A notable absence from the top rankings is 🇻🇪 Venezuela, which holds the largest proven oil reserves on the planet. Despite this potential, the nation remains outside the top exporters due to a combination of aging infrastructure, sanctions, and the technical complexity of refining its "extra heavy" crude, which requires significant investment to process.