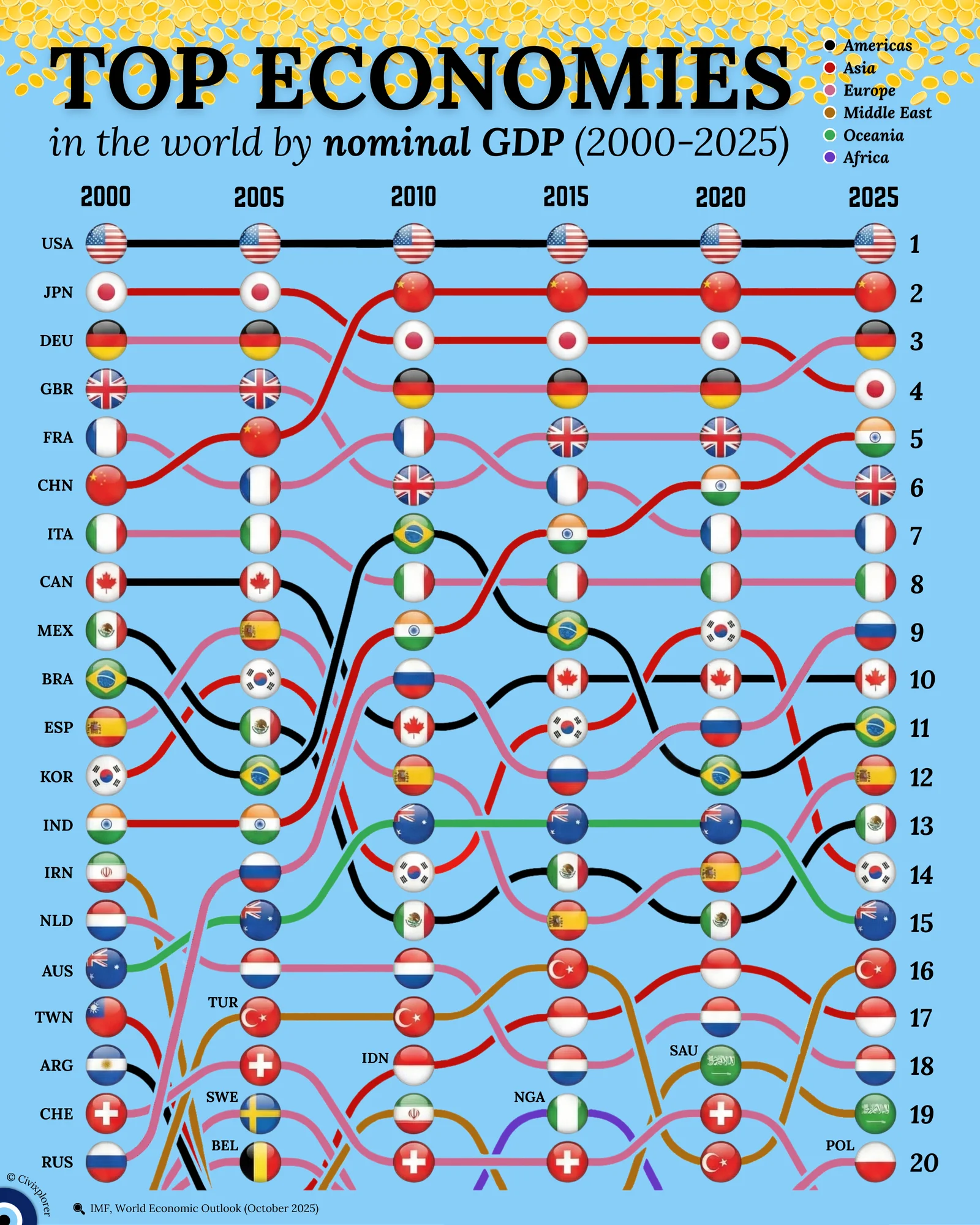

The global economic landscape has undergone a seismic shift over the last quarter-century, transitioning from a Western-dominated environment to an increasingly multipolar world. A visual analysis of the top 20 economies by nominal Gross Domestic Product (GDP) from 2000 to 2025 reveals a dramatic transformation led by the rise of emerging markets.

The most striking feature of this era is the meteoric rise of China. In 2000, China occupied the 6th spot globally. However, following its entry into the World Trade Organization (WTO) in 2001, the nation rapidly transformed into the "world's factory." Through massive infrastructure investment and a strategic pivot toward high-tech manufacturing, China overtook Japan by 2010 to become the world’s second-largest economy.

India has followed a similar upward trajectory. Driven by a significant demographic dividend and a powerhouse services sector—particularly in IT and software—India has climbed steadily from the bottom of the top 20 at the turn of the century. Projections indicate it will secure the 5th position by 2025, fueled largely by domestic consumption and service exports.

In contrast, traditional European powers such as the United Kingdom, France, and Italy have experienced a "relative" decline. While these economies are not necessarily shrinking, their growth has been outpaced by Asian counterparts. Factors contributing to this trend include aging populations and slower recovery cycles following global financial crises. Germany remains the exception, maintaining its status as the most resilient European power throughout this period.

The volatility of commodity-dependent nations is also evident. Brazil and Russia have seen their rankings fluctuate like a rollercoaster, heavily influenced by the "super-cycle" of oil, gas, and mineral prices. Meanwhile, new contenders like Indonesia and Turkey are asserting themselves, representing the "Next 11" group of economies driven by rapid urbanization and internal trade networks.

It is important to note that these rankings are based on nominal GDP at market exchange rates. When viewed through the lens of Purchasing Power Parity (PPP), which accounts for the cost of living, the influence of China and India appears even more dominant, reflecting their immense internal economic power.

Comments (0)

Join the Conversation

Login to share your thoughts with the community.

Login to Comment