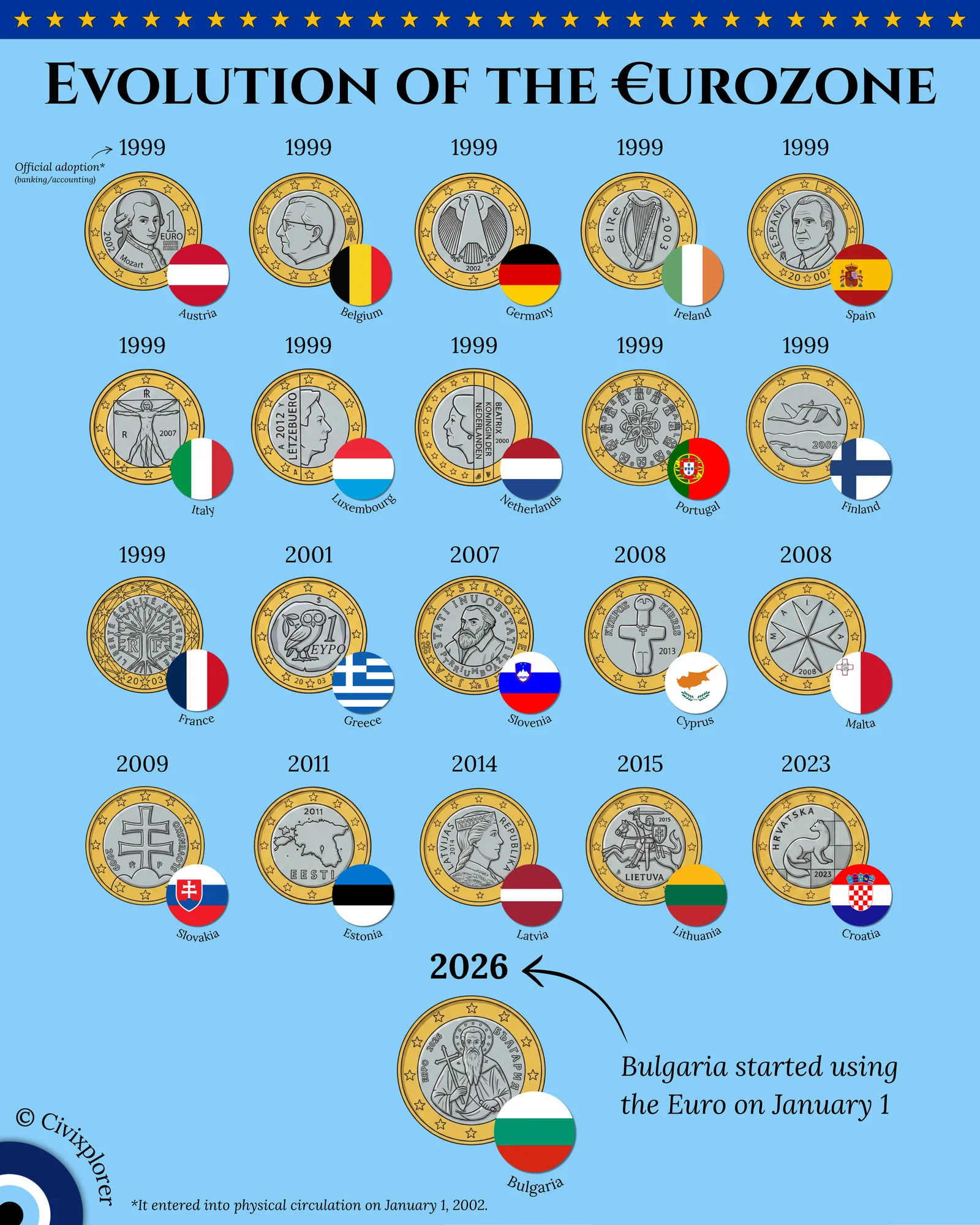

The steady expansion of the Eurozone represents one of the most significant chapters in modern economic history. Since its electronic launch on January 1, 1999, with eleven founding nations, the Euro has evolved from a bold experiment into a primary currency that anchors the European market. This journey toward economic integration is not just about finance; it is a story of national identity, political hurdles, and strategic shifts across the continent.

The timeline of adoption reveals a shifting geopolitical landscape. Following the initial group, Greece joined in 2001, a move that would later bring significant scrutiny to the region's economic data. Between 2007 and 2015, a "Post-Soviet Shift" occurred as nations like Slovenia, Estonia, and Lithuania adopted the Euro. For these countries, joining the Eurozone served as a symbolic and strategic anchor to the West, signaling a permanent departure from previous economic spheres of influence.

After an eight-year lull, the Eurozone is experiencing renewed momentum. Croatia successfully adopted the currency in 2023, and Bulgaria is officially set to become the newest member on January 1, 2026. Bulgaria’s entry is a major milestone, suggesting high confidence from the European Central Bank in the nation’s economic stability and its ability to meet strict convergence criteria regarding inflation and public finances.

A unique feature of this monetary union is the design of the coins themselves. While the "common side" showing the value is standardized, each nation issues its own "national side." These designs allow countries to retain a sense of sovereignty and culture within a unified system. For example, Ireland features the Celtic harp, Austria showcases Mozart, and France uses a stylized tree representing liberty and equality. Bulgaria’s upcoming coin will depict St. Ivan Rilski, the country's patron saint, emphasizing its historical and spiritual heritage.

Despite this expansion, the Eurozone does not yet include every European Union member. Denmark maintains a legal opt-out to keep the Krone, while other major players like Sweden, Poland, and Hungary continue to delay the process due to public skepticism or a desire to maintain independent control over their national interest rates. As we look toward 2026, the evolution of the Euro remains a dynamic testament to Europe’s ongoing pursuit of unity.

Comments (0)

Join the Conversation

Login to share your thoughts with the community.

Login to Comment