The global financial landscape is entering a period of significant realignment as we look toward 2026. This transition is defined by the growing competition between the Group of Seven (G7), a coalition of established democratic economies that has historically set international rules, and the expanding BRICS bloc, which represents the emerging powerhouses of the Global South.

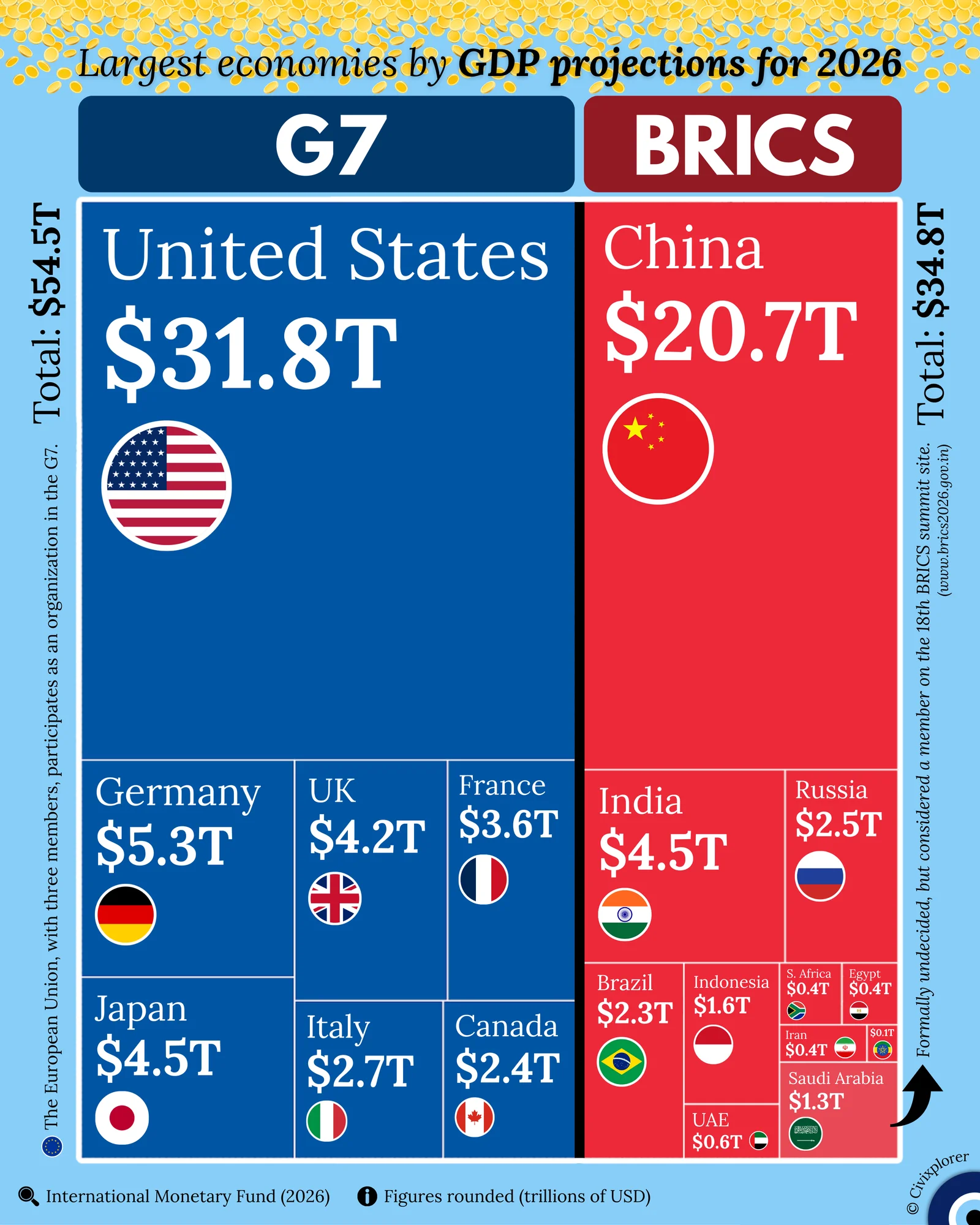

According to 2026 projections, the G7 remains the leader in total nominal GDP with a combined value of approximately 54.5 trillion USD. The United States continues to be the primary engine of this group with a projected GDP of 31.8 trillion USD, followed by Germany at 5.3 trillion USD and Japan at 4.5 trillion USD. However, while these established powers maintain high nominal figures, the narrative has shifted regarding growth. In 2026, BRICS nations are projected to grow at an average rate of 3.7 percent, which is nearly triple the G7's sluggish 1.2 percent.

The BRICS nations are expected to reach a combined nominal GDP of 34.8 trillion USD by 2026. China remains the dominant force within this bloc with a projected 20.7 trillion USD GDP, but India is the standout for 2026. Projecting a 4.5 trillion USD GDP, India is positioning itself as a strategic bridge between the West and the Global South. The recent expansion of the bloc has also introduced significant geopolitical leverage. With the inclusion of the UAE, Iran, and Saudi Arabia—which acts as a de facto member despite being formally undecided—the bloc now controls a massive share of global oil exports.

A primary objective of this expanding "multipolar" world is de-dollarization. By utilizing local currency settlements and Central Bank Digital Currencies (CBDCs), BRICS members aim to bypass Western-dominated financial systems and sanction-proof their economies. Furthermore, the inclusion of countries like Egypt and Ethiopia is highly strategic; these nations control vital trade routes such as the Suez Canal and the Nile, ensuring the bloc's influence extends into global logistics and resource management.

Comments (0)

Join the Conversation

Login to share your thoughts with the community.

Login to Comment